By Alvan Ewuzie, Sun News Online

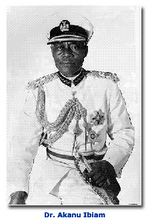

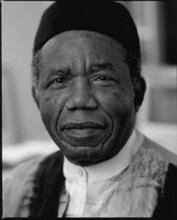

When the Englishman said dynamites also come in small sizes he was probably talking about Professor (Eze) Green Nwankwo. He stands at about five feet but he typifies dynamite virtually packaged in a bottle. Take the samplers; he is the first Professor of Finance in Africa, the first black to make a First Class in a Scottish University, the First Head of Department of Banking and Finance at University of Lagos, the First Executive Director (monetary and Regulation) Central Bank of Nigeria.

The list goes on. But his turf and major area of competence is in banking. That is why Green Nwankwo feels a personal sense of loss at the pervasive rot in the industry and insists that it all boils down to the human element. When he spoke to Daily Sun last week in Lagos, he took us back to the basics, the essence of banking and why current generation of bankers have floundered. A management guru who has traversed many a board room Nwankwo, still sprightly at 76, understands the dynamics of business organizations. He regrets that professionalism has been sacrificed on the alter of greed and compromise.

He gives full marks, as the typical teacher that he is, to current Central Bank Governor Lamido Sanusi describing his action as “consolidating the consolidation.” He tells his inspiring life story lacedd with last minute interventions and resolutions that radically changed his life. The interview is both a lesson in banking and a window into courage and determination.

Excerpts:

Early days

I was born in Arondizuogu in Imo state 76 years ago. I was born on September 11, 1933. I started primary school in 1938 at St Peter’s CMS school Arondizuogu, finished in 1945. I was a teacher for two weeks in January 1946 before I was sacked. I then went to Aba to become a house boy to a business man there. In 1947 by a stroke of luck I entered the secondary school at the then Africa College now Our Ladies high School Onitsha. I finished in 1950 with a senior Cambridge Certificate. By 1951 I had my London matriculation and started working at the then Bank of British West Africa, now First Bank in Port Harcourt on August 13, 1951. I was there for nine years, one month and one day. I resigned on September 14, 1960. I left the shores of this country three days to independence that is on September 27, 1960. I was at the Scottish College of Commerce in Glasgow Scotland.

I was in the United Kingdom for seven years i.e. 60 to 67 when I graduated with a doctorate. I got Diploma in Banking in April 1962 then BSC Economics with speciality in money and banking in 1964 then ACCA with a First class in Glagow in 1966 then Msc and PHD in two years. I submitted my doctoral thesis on July 15, 1967. You will recall that the Nigeria civil war started July 9, a week before I submitted my doctoral work. So I could not come home after my studies because of the war. I then needed to eke out a living. So I applied and was interviewed for a teaching appointment at City of London College on September 18. In fact September is my month. I got my Phd on September 11 and I chose that day to be my birth day because there was no record when I was born.. it was my maternal uncle who was able to guess that I was born in 1933 but there was no specific date.

And in all the academic forms we were filling in those days they would always ask you to put your birth day so I chose September 11 because people just kept advising me to just choose one day in order to stop all the queries and embarrassment about birth day. So I chose the day I got my doctorate. At exactly 9am September 25, 1967 I was standing before a class in London City College as a lecturer. So September is really my month. I lectured for five years before I returned to Nigeria. I left London December 14, 1972 and arrived December 15 and drove straight to the University of Lagos to set up the Department of Finance. I was the first Head of Department or whatever name you may chose of that department.

The department itself was the result of an endowment by the United Bank for Africa [UBA]. I was invited home to come and start it. I returned as Associate Professor and got my full Professorship on October 20, 1974. I started the department and headed it till 1978. I left for the Central bank as pioneer Executive Director which they now call Deputy Governor. But to complete the university part of my story, I was actually acting Head of department because at that time you could not be a full head of department except you were a full professor. In 1976 I was made the Dean of the faculty of Business Administration at UNILAG. I joined the Central bank in June 1978 and stayed there till December 1984 when I was asked to return to the University. Then from 1985 to 1987 I was president of Chartered Institute of Bankers of Nigeria. In 1988 I went on my first ever sabbatical at the City of London College

Where you once taught

Yes. I returned there on sabbatical twenty years after as a visiting professor. In 1989 I returned and was appointed chairman of Raw Material Research institute where we produced the blue print that led to the formation of Raw Material Research Council. In 1990 I was appointed chairman of the board of Union Bank. I was there until 1996 when I voluntarily retired from that position and went back to the university. In any case I had always been with the university. In 2001 or thereabout I became chairman of the then ACB International bank until 2005 when it merged with five other banks to become the current Spring Bank. I was a founding member and director of Chattered bank which today has merged with Stanbic IBTC.

About 2003 I was invited home to become a traditional ruler. I was coronated in March 2005 as Eze Ohazurume 1 of Aro Amuro in Okigwe local Government Area of Imo state. That’s my brief story.

You said you were sacked on your first job and that you went to school by stroke of luck. Could you comment further on those issues?

Well I would say I was famous in the primary school. I was too small and perhaps too young. There was a huge contrast between my height and my class. People always picked me out as a sight to behold because I was far too small for my class. I did the First School leaving certificate examination in 1945. I became a problem for the Headmaster.

They did not know what to do with me. In those days there were only two major jobs available, namely Teaching and Court clerk. I did not have the size to be a court clerk. So Mr Nwagbo now took it upon himself to do something about my case. So as he was going on transfer in December, he appointed me a teacher at the CMS central school in Orlu. But because the schools were on Christmas break I resumed on January 29, 1946. It was his first appointment before he left. Then a new man came and saw my application and appointment letter and said he wont allow me teach. He said I was too young and too small.

He said I was too young and too small. So, on his way to Onitsha he stopped over at Orlu and told the headmaster to call me. It was break time and I was with my pupils playing school band and dancing. He said to me “sorry my son, you cannot teach. Your appointment has violated all teaching records, you are underage and undersize. Your appointment has been terminated. See me in two weeks time in my station. Meanwhile go and tell your parents to send you to secondary school.” That’s how my appointment was terminated. So I returned to the village. At that time, there was no question of wearing clothes. So I returned to my raw village boy and that became a problem and an embarrassment. There I was, a first school leaving certificate holder, now a teacher still running around the village naked. My maternal uncle then decided to send me out of the village. He sent me to an Aba based merchant to live with him as a houseboy. Again as a houseboy I was adjudged to be smart. Each time visitors came, my master would send me to get something for them. I would carry it out smartly.

They began to ask my master, who is this boy?” he would tell them my story and they would scold him for keeping me as a house boy and not sending me to school. That was how the discussion about my going to school started. Everybody who came to the house kept pestering him. I was small and sharp. So all the visitors easily noticed me and kept pestering him. He was forced to write a letter to my father to come and enter into a bond that he would send me to secondary school in an evening school. The bond was that after training me, I would then train his nominee.

My father was an illiterate, so he gave the letter to someone to read for him, my maternal uncle. After that he was told that he was sending me to slavery by accepting the condition. They told my father that he was rich enough to train me. He said he could not do it. They piled pressure and cited examples of other people he was better than but he refused. My uncles now told him to pay for only the first term while they will pay for the second term so that I can start.

That was how my father was lured to send me to secondary school. Having now committed himself he could no longer back out. He was a proud man with integrity. Each time I came home, people would be mocking him to say that he would be unable to finish training me in secondary school. He then felt challenged. That’s how I went to secondary school. That’s why I said, it was by chance. It was also by luck that I went to the university. As I told you, I came out December 1950 with Senior Cambridge Certificate. In 1951 I sat for the London Matriculation and passed. I started working at the bank on August 13, 1951. I was married in 1956. My wife joined me on March 6, 1956. I was in Port Harcourt.

After secondary school in Onitsha, I began looking for a job. I went to my cousin who was a carpenter in Port Harcourt at the Ports Authority. I lived with him while looking for a job; eventually I got a job at the bank. At that time it was a colonial bank and there was no system of promotion. You only rose by regular annual increment. I paid the dowry for my wife on February 29, 1956 in the village and she joined me in Port Harcourt the next month, March 6, 1956. At that time the annual increments used to come in April at the end of every financial year, but the appraisal and recommendation would have gone to Lagos in December.

The results would not be announced until after the end of the financial year in March. Early in April the results were announced. That was another turning point in my life. When the results were announced; I was almost at the bar of a particular grade. I was short with about 3 pounds from the next grade which means that our normal annual increment will move me into denial because the increment was about 13 pounds or so.

There were five of us involved. We jointly put up a petition telling the white manager that it was unfair that we will all lose sums of money due us because there was no clear method of promotion. So he demanded that we be given our normal increases and the difference topped on it. So when they paid it turned out that two of us who were only three and five pounds below the bar were losing heavily. So we put up a petition to the manager. Then we were invited individually to defend our cases. I told the manager that while I did not begrudge the others that I was senior to them since I was only three pounds to the bar while they were far below. He asked me to give other reasons and I told him that I had not received any query and that my services had been largely satisfactory and above all I am the most qualified.

Then he asked what my qualifications were and I told him I had Senior Cambridge and London Matriculation. The man got angry and said “to hell with your Senior Cambridge, to hell with your London Matriculation.” My God I felt terribly bad, fire literally gushed out of my eyes. My pride had been destroyed. I got there with only school certificate but before my appointment was due for confirmation my London Matriculation had come.

I was a center of attraction there. People will say come and look at this small rat in the bank who has Senior Cambridge and London Matriculation. And this manager made nonsense of the entire thing. I was so infuriated that as small as I was, I was minded to jump up and slap him. But the good Lord intervened and I held back. Why did I hold back? There were two major reasons. One I would have been dismissed if I did that. But I would not have bothered except for the second reason. The second and main reason was that my wife had just joined me on March 6th and I paid the dowry with ESUSU, so I was in debt.

What really happened was that when I started working in 1951, the business atmosphere then was largely family oriented which was why you had business names like “Okeke and Sons,” Nwankwo and brothers so I started a trade for my younger brother with some money I had saved hoping that after some time I would resign to join him so that we can have our business “Nwankwo and brothers.” So by December 1954 I went on my first leave to the village.

My brother went first to the village. When he came back I now went. In those days if you came back to the village and you were able to buy a packet of sugar, you gave out a cube each to people. If you bought bars of soap, you also gave out little portions of it to everybody. Then you topped it up with cabin biscuits, that was the in-thing. When I came on leave and gave out those things, the people were receiving it coldly. They did not show appreciation. So I began wondering what had happened. When I made enquiries they told me that when my brother came back, he bought things for them, including wrapper and several other things and that they expected even greater things from me since I was the elder one.

When I came back to Port Harcourt I asked my brother to give account of the business. I then found that he had squandered the whole money. In fact the scandal was so much that some of my father’s wives were saying they wished my younger brother was the first born, that their lives would have been better because he was generous. What they probably did not know was that I was labouring at the bank to get the money while he was squandering it on them instead of using it to grow the business.

So he squandered the entire money and nothing was left. I became alarmed. I examined myself again. I began working in 1951 and we were in January 1955. I had no savings, I was not in school, nothing. I was running the risk of being called a rif-raff, an ‘Ofeke’. I then decided that I should at least get married if nothing else.

Besides, my uncle whom I was living with was married with four children. And I found that I was spending more on feeding than him and he used to pass on every expenditure to me because, as he put it, I was not married. So I was spending a lot. All these calculation convinced me that it were better I got married so that I would have something to show and I will not be called ‘OFEKE’. But I had no money to marry. My brother had squandered everything. I now went to the office and organized ‘ESUSU’ with eleven other people and we were contributing ten pounds each, every month. I took last December 1955 and first in January 1956 and I had 240 pounds with which I went home to marry. I still got some change with which I bought a ladies Raleigh bicycle which was the Hummer Jeep of those days.

Therefore, the consequences of slapping the Oyibo manager and getting sacked was too enormous. Firstly I had just taken somebody’s daughter to Port Harcourt as my wife, secondly I was in debt because of the ESUSU.

I calmed down and then told the Oyibo man “I don’t blame you for what you have said. I don’t blame you for placing no value on my Senior Cambridge and London Matriculation which I got in 1950 and 1951 respectively and here I am in 1956 still arguing about those two certificates. I don’t value them myself”. He said why? I said if I value them, after these four or five years, I ought to have done something to improve myself. Don’t worry it is a food for thought.”

He said “go and think and do your worse.’ As I stepped out that morning from the manager’s office, I took three resolutions. The first resolution was never to work in the bank again, two to leave the bank for better and three, to be in a position in life that I can dictate policy to banks. Now how could I achieve those resolutions? I did what today is called SWOT analysis in management and I found that my strength is in academics, that same thing the manager debased. The only way I could leave the bank for better was to get a higher qualification and that was why I resorted to private studies and registered with rapid result college in London. I also began taking AIB examinations. In 1958 government set up Ashby Commission on higher education because of the approaching independence. That committee reported in 1959 advising the federal government that because of the pending independence, it was necessary to train manpower to run affairs of the country. It advised government to open up and offer various scholarships to people.

In that year, 1959, the Federal Government published vacancies for scholarships and I looked at it and decided there was nothing I was qualified to apply for; except banking. Don’t forget that I had resolved never to work in the bank again. Three days to the closure of entry, we were somewhere chatting and somebody asked me whether I applied for the scholarship and I said no. He said I should have applied for banking. I told him I already had enough of banking with all the trouble of balancing the books before you go, even during holiday periods. He explained that I do not necessarily have to be in the banking hall, if I get my AIB, that I could be a consultant or something else. The way he put it made the scale to fall off my eyes. I jumped on my bicycle and ran to obtain the form. This was in 1959 and the interview was to hold here in Lagos and that became my first time of venturing out of the East.

Immediately I entered the interview venue they said your name is Green, who gave you that name, why do you answer such a name. As a small boy that could be very unsettling. I told them my parents gave me the name and they said why do you still retain it, why don’t you change it. I said I won’t change the name. They said why not, I told them about one Chief Green Mbadiwe from my area who was a millionaire, a gold miner and renowned entrepreneur, that I won’t change the name because I hoped to be a millionaire like him, one day. Green Mbadiwe used to do something in those days when women and people came to dance in his house.

He would stay upstairs and be throwing coins down to them and that fascinated me a lot. I said I won’t change the name because I hoped to become a millionaire like him, someday: That was the only exchange of questions I could remember. I got the scholarship. I sent my papers to Lagos but there was no response that 1959. A friend of mine who was working in Customs had advised me not to indicate that I was married in my application form, that government was conserving money and was, therefore, not giving scholarship to married people. I flatly refused to heed his advice, insisting that I won’t deny my wife because of scholarship.

When I did not get a response that friend of mine kept laughing at me for refusing to heed his advice. I had already got part one of AIB, I only applied to go overseas and complete it. So I knew that even if they didn’t give me, I still had a chance of completing the programme in two years, even by correspondence. He kept telling people that I was the cause of my problem because I refused to denounce my wife and tell lies. I was then determined to go to Lagos and find out what had happened. On September 26, 1960 I was in Ministry of Education in Lagos to collect my papers when I eventually got the scholarship and I was shocked when I saw that instead AIB for two years I had been given B.Sc (Economics Money and Banking) for four years.

I wanted to know what happened. I had the opportunity when they were looking for a messenger to go and get my file and I volunteered my self. When I got the file, I quickly looked at it and saw what happened. It was that the placement officer, a Scottish lady who did the appraisal reasoned that it would be a disservice to me and the nation if I was to go for only Part two of AIB when I already had part one and RSA advanced. She now insisted that I should go for degree programme. Because of my determination to leave the bank for better, I was doing both AIB and RSA and got both at the same time. When they saw my papers they said I should go for degree. It was the process of correspondences between Lagos and London that delayed the entire thing. This placement officer was so convinced in her judgement concerning me that she had already got a university for me.

That was how my diploma became degree. In 1962 I got distinction and that put my school in the map. I still did the second part of AIB privately. I won the prize of most distinguished candidate in ’62 and the Glasgow Prize in ’63 when I took the B.Sc final exam. I became the darling of my professors who then said I must do post graduate. They sent my papers to London School of Economics. I made First Class in the exam in my school and Second Class Upper in the external examination. They eventually granted me admission to do MSC and PHD.

The problem then was how to finance the programme. They advised me that since I had four years scholarship and had only done three, I could at least use the fourth one to begin. So I started and they now wrote to the Federal Government and gave very high recommendation that I should be given further scholarship for Post Graduate Studies. Nigeria was a different place at that time. They promptly replied and extended the scholarship to cover both MSC and PHD. One of my happiest recollections is that those three resolutions of April 1956 had been amply fulfilled. I never worked in the bank again. I left the bank for better and I am now a policy maker for banks. That’s my joy. I have done this through teaching and writing several text books on banking. It gives me joy.

I consider you a pioneer banker

Oh yes. I was the first Professor of Finance in the African continent.

That’s good. Congratulation sir. Now do you think banking of today is still being practiced the way you taught it?

I would say yes and no. Yes in the sense that banking remains what it is; an intermediary between those who have surplus funds to their immediate requirement and those who need funds. The former put their money in the bank, the later go there to borrow it and the interest rate becomes profit for the bank. To that extend they are still practicing banking in that they make their income through the difference borrowing and lending rate.

I also say no in the sense that integrity both on the part of the bankers and the borrowers and customers is no longer there. That integrity is very much watered down, vitiated. One head of state once said that Nigeria’s problem is not money but how to spend it and that has coloured the thinking of people. ‘They believe the money is there and everybody wants to grab their own at all levels. That has also permeated into people who borrow money from the bank. They see it was their share of the national cake, so they really have no intention to pay back. And some of the bankers appear to have compromised their positions by taking kick backs from people they have lent money. If you do that, you have mortgaged your right to demand for repayment. That is why I said yes and no. Banking remains what it is but the ethics have been vitiated. Banks can only survive and continue in business if those who borrow, pay back.

It is also said that the regulatory authorities have abdicated their responsibility.

Part of the problem is regulatory failure. The rules are there. In fact there is a regulatory failure and the challenge of Corporate Governance today is one of supervision and monitoring. There is failure in regulation and there is also failure in internal mechanisms within the banks themselves or inability to institute and execute internal control. Then there is the failure of both internal and external auditors. People also don’t seem to know that money can be evil and devilish if you are not careful with it. Money is also gregarious.

You know the consolidation moved start-up capital from N2bn to N25 billion. Somehow, they achieved what I describe as skeletal consolidation. Some banks came together and survived. Then they were told that anyone that got N100 billion would be given portions of foreign exchange to manage. That now brought about competition for size and bankers began buying positions. Such things as Banker of the year and so on. Those things were paid for. I can tell you that some of those awards were also offered to me but because I had no money to pay so they never gave me.

They paid for these awards with bank money, depositors’ money. Also infrastructure deficient universities saw a good avenue in distributing awards to bank bosses and getting money to solve their problems. The regulators perhaps thought that since the banks were big now they could lend to the real sector. What the current governor is doing now is what I describe as consolidating the consolidation. The consolidation that was earlier done was a skeletal one. What is happening in the banking industry now is the real consolidation. If these current measures are taken to their logical conclusion, you can now get real solid banks. That’s why I support what Sanusi is doing.

Is there a possibility that number of banks will reduce, after all the clean up currently going on?

Let us face it, even while Soludo’s consolidation was going on, there were opinions, and I shared in those opinions, that we need not have one-size-fits-all banks. In America and elsewhere in the world, you do not have one-size banks; you have banks of various sizes serving various stages and sectors of the economy. To think that if you reduce the number of banks and make the remaining ones big, everything will be all right, you might be making a mistake. There are pros and cons of reducing the number. What we need is an efficient banking system. Size does not tantamount to efficiency. And let me also say that like death bank distress is no respecter of size or age. It does not matter how big or old your bank is, once you violate banking rules, you will go down. The regulators, I believe, know what to do but I have made my point.

When you were in the regulatory system as Pioneer Executive Director of the Central Bank, were there signs that what we are seeing now would happen?

At that time we had two classes of banks. We had indigenous banks and expatriate banks. Expatriate banks were bigger in size and operated on rules and principles from their home countries. They did not necessarily pay particular attention to developing indigenous borrowers. In fact it was this discrimination against citizens that led to the establishment of indigenous banks. The ACB for instance, I told the story in one of my books titled Nigerian Financial System. Nnamdi Azikiwe set up ACB because of what he claimed to be the insult he received from an expatriate bank.

He said “they treated me as if I am lazy and I told them that one day I will own a bank.” And he later owned a bank. What I am saying is that the expatriate banks were bigger and relatively more efficient but not necessarily developing the economy. The indigenous banks were more down to earth. At that time ACB, National Bank and others built up a number of businesses. But then greed, corruption and the Nigerian factor got into them and this became more evident when these banks became state owned.

Appointment into the boards became an issue of political patronage. If you are talking about what happened then, I will tell you that Rome was not built in a day. What is happening today did not just occur overnight. And, whatever regulation you have will succeed or fail depending on what the operators do with the regulation. Therefore it depends on the human factor, on the integrity of those operating the system. I told you earlier that I was chairman of Union Bank from 1990-1996 and that I voluntarily resigned my position as chairman in March ’96. I am yet to see another precedent. I took that unprecedented move to resign because I could not agree with what was going on.

Could you be more specific on those things?

All I can say is that there were unhealthy practices which I vowed can never happen under my watch as chairman. I said I will not append my signature to those things. It got to a point where the board members held meeting without me. In fact they would not even let me know about the meeting because they know I will not agree. At that point I wrote to the Central Bank reporting the ugly development where annual account of the bank was approved without the chairman’s consent. The CBN now put its feet down and demanded that a proper board meeting be held.

They directed the external auditors and the Managing Director to comply. Well they gave ethnic interpretation to the whole thing because Paul Ogwuma was Governor of the CBN at that time. I didn’t bother about that because I knew I was standing on both moral and professional high pedestal to insist that things must be done right. When it became obvious that mine was like a lone voice in the wilderness I made what I consider a profound statement at the proper Annual General Meeting at Nicon-Nuga in Abuja in March 1996. I said and I quote “There comes a time in the life of a man when he has to take a decision, for me that moment has come, I hereby resign my appointment as chairman of this bank” that was it. I was not going to be part of any illegality so I resigned. And people could not understand me but I had my reasons which I would also not discuss on the pages of the newspaper but I have documented them in my biography. I will give you a copy but I would still not want you to specify them in your report. Anybody who wants to know should get a copy of my biography captioned “Journey to the Throne –“ the story of Eze professor Green Nwankwo.

Are these unethical things or where they politically motivated?

Some were unethical and some were politically motivated. People were saying why did you do that, why did you resign such an exalted position. Don’t forget that not only did I start banking in August 13, 1951, I was a ledger keeper. It was at that time that I saw the back of all these so-called rich men. They are all chronic debtors. That coloured my attitude. So when I now see a big man, I will say wait until we see the bank account. If you have been following the revelations now coming out of banks, you will find that some directors gave themselves loans in order to buy shares of the same bank and be qualified to remain there as directors. Some gave loans to companies where they had interest. They clearly had no intention to pay back and those who compromised their position by taking kick backs from people they gave loans to have lost their moral authority to ask for repayment. That’s why the borrowers are bold not to pay back. That’s why you need intervention of external body like the EFCC to get them to pay back.

The point I am making is that the challenge facing the banking sector is that of enforcing strict corporate governance. The regulators have to be on their feet but whatever you do always boils down to the human factor, the integrity of the regulator and those being regulated. In my own case I put my feet down and said no way, I won’t compromise. I was chairman of ACB before the merger and I can tell you that in three years my board removed two CEOs and the third one was on compulsory leave before the unfortunate Bellview crash where he died. Why we removed them was that after we hold board meetings and agree on what to do and how it should be done, they would go and do another thing. When you ask them they say this is how it is done in the industry and I would say you don’t have to follow the multitude to do evil. Please do what the board agreed or leave. When I report them to the board the conclusion would be that they have another agenda and that’s how two of them left. In fact there was a time the external auditors wrote to say that they were withdrawing because of pressure.

This brings up the issue of auditors. Where were they when these banks were being run aground? Does it mean they colluded or their reports were ignored?

I would not know but recently the current CBN Governor Lamido Sanusi recently asked the same question while he was addressing members of ICAN. He said where were the Accountants and auditors when all these things were happening. That’s why I say that what is happening now calls to question the integrity and professionalism of the regulators, auditors, directors and everybody. This is why I support and welcome the cleaning now going on. Of course it is hurting and it is bound to hurt. As I have already said, my assessment is that the process will consolidate the consolidation.

As chairman of ACB your board was able to remove recalcitrant CEOs but now we have super CEOS who are even bigger than their boards, who can flout a board decision and still get away with it in the sense that they are like the owners of the bank.

One of the measures Sanusi is taking is to depersonalize the banks. You know under Soludo family owned banks were also de-emphasised which brought about mergers. It would seem that they returned through the back door.

The situation also challenges the integrity of the chairmen and board members if they will fold their hands and watch the CEO upturn their collective decision. I was recently reading about the Nuhu Ribadu saga and he said he gave his staff what he called “the front page rule” which means that if you take a decision or do something that can appear on the front page tomorrow morning then you ask yourself can I defend this? He said if you could defend it then go ahead and do it, but if you cannot defend it.

Monday, October 26, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment